Amendments protecting the interests of Russians will not lead to problems with credit cards - the Government of the Russian Federation and banks will find an acceptable solution. About it FBA “economy today” told the President of the National Institute for Systemic Research of Entrepreneurship Problems Vladimir Buev.

Amendments to the law “About consumer credit” pose serious risks for retail banking, including the credit card segment. This statement was made by the Association of Russian Banks (ADB). The bill passed the first reading in the State Duma and is intended to protect Russians when receiving loans from imposed additional services, insurance and commissions. And if any will be charged, then the bank will be obliged to return them to the client in double the amount. But it turned out, what concept “imposed services” can be interpreted very broadly.

For example, when issuing a credit card to a client, banks set a commission for transferring money from it or withdrawing cash. And Rospotrebnadzor has already created judicial precedents, when the limited credit issued on the card cannot be subject to additional fees. New bill threatens to legitimize this point of view. so, credit card fees, bringing banks the main income in this segment, will be outlawed. Banks send complaints to instances against the draft law.

“The current situation reflects the current imbalance in the Russian banking market, which should ideally be governed by simple competition, – notes Buev. - FROM 2014 the Bank of Russia is cleaning the market from unscrupulous organizations, with which money was laundered, enterprises went bankrupt and other fraudulent activities were carried out. Really, There are much fewer problem banks in Russia, and the situation has stabilized.

But under these “cleaning” bona fide banks also hit, in a difficult situation as a result of the financial crisis or situational problems. These are hundreds of institutions in various regions of the Russian Federation - they were deprived of their licenses due to problems with capitalization, lack of working capital. As a result, the number of banks in Russia has significantly decreased, and therefore, the competitive environment has also changed. In fact, the market was divided by a dozen large players, the main of which - with the participation of the state.

And it is these banks that dictate the lending policy, credit card regulations, interest rates. Small players do not have the ability to influence the overall situation”.

Banks are interested in commissions and fees

Controversial amendments to the current law “About consumer credit”, in particular, prohibit banks from conditioning the issuance of a loan, eg, purchase of insurance and additional services by the client. The government considered these innovations fully justified to protect the interests of citizens. If the borrower's right “free choice” will be broken, he will be able to count on damages. The second reading of the bill in the State Duma was to take place in October.

According to banks, the innovation will too expand the rights of borrowers and allow to collect money from banks for violations directly - even without a court. Whereas with 2021 years, bank clients will be able to file complaints with the Financial Ombudsman. And now Russians can complain about banks to Rospotrebnadzor, Central Bank or go to court. The new version of the law will allow to demand compensation from banks without litigation, what credit institutions don't like.

“Bank is an organization, designed to make money, everything else is secondary to him. It means, that the leadership of such institutions is interested in a maximum of various commissions, fees, insurance and other tools, allowing to squeeze the maximum money out of the borrower. And the state sees, that many such tools infringe on the interests of Russians, therefore tries to prohibit these fees.

But due to the fact, that there is insufficient market competition, large banks have the ability to push their position. De jure there is no collusion between them, so talking about monopoly will not work. But de facto, they all introduced fees for withdrawing money from credit cards., than deprived the Russians of choice. If there were more small independent banks in the regions, then the Russians received more profitable services.

That is, commissions in the credit card segment would be replaced by other service fees or zero altogether.. And now the government and banks are forced to solve the problem, what is called, in manual mode”, – emphasizes Buev.

We'll have to negotiate

The State Duma Committee on the Financial Market said, that an alarm has been received from banks, and the deputies intend to solve the problem. In particular, ADB invited to write its own version of the bill, to ultimately try to combine the positions of the government and banks. How much interests can be balanced, parliamentarians do not presume to judge. But we already know, that the second reading of the bill was postponed from October to December.

So far it is clear, that the amendments to the law “About consumer credit” nevertheless, they will appear - the Cabinet of Ministers and the State Duma do not intend to refuse from the intentions to strengthen the protection of the interests of Russians when taking out a loan. On the other hand, conditions, when the borrower can dispute the purchase of additional products or services from the bank, will be clarified. But interest for transferring or withdrawing money from a credit card, Most likely, will remain - Russian banks are not ready to give up these incomes.

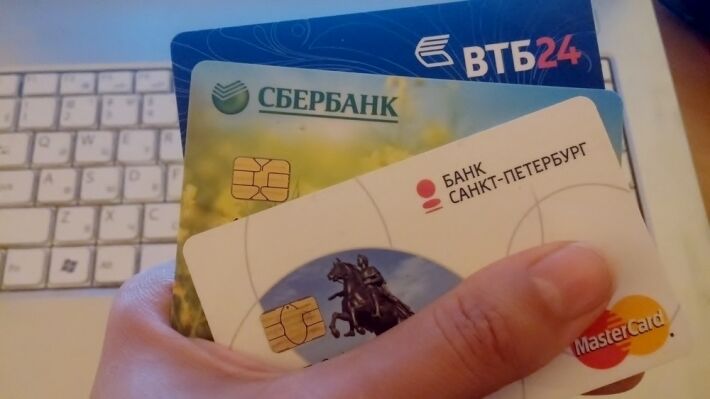

“State Duma tactics show, that a consensus will be found - the interests of large banks with state participation will have to be taken into account. These are system players in the market, setting the development of the entire credit sector in Russia. So ignore the positions of the same “Sberbank” or VTB just won't work. But it is also impossible to follow their lead - the rules of the game are dictated only by the state through the regulator, to whom this work is entrusted.

So no crisis is foreseen in the credit card segment – as a result, banks will adapt to the new rules, and clients. Last, perhaps, reduce interest when using credit cards. But in general, the situation with competition in this segment of the economy will have to change. And then many applied problems will be solved by themselves - by the mechanisms of natural market regulation”, – concludes Vladimir Buev.

Max Boot