Foreign policy pressure on the Russian Federation in the energy sector had an impact on the exchange rate of the Russian ruble, considers Associate Professor of the Department of Economic Theory of the Financial University under the Government of the Russian Federation Peter Arefiev.

The ruble is affected by negative external conditions

Today, the euro exchange rate on the Moscow Exchange rose by 0,43% and reached 90,05 ruble. During exchange trading, the exchange rate of the European currency rose to 90,4 ruble, ie. to a new record 2016 of the year, when the "Russian" showed historical lows.

The dollar exchange rate also rose against the ruble and reached 76 units - at this level, the "American" was quoted two weeks ago.

The question arises, and what is it. Ruble volatility in the new exchange rate range or further devaluation, after all, there is instability in the financial market of the Russian Federation due to the “coronacrisis”, problems in the global commodity market and threats of new sanctions.

“Energy prices are acceptable. Oil was able to gain a foothold at the level of 42 dollars per barrel, and no further price catastrophe is expected for gas, but there are questions about the prospects of Russian energy companies”, - concludes Arefiev.

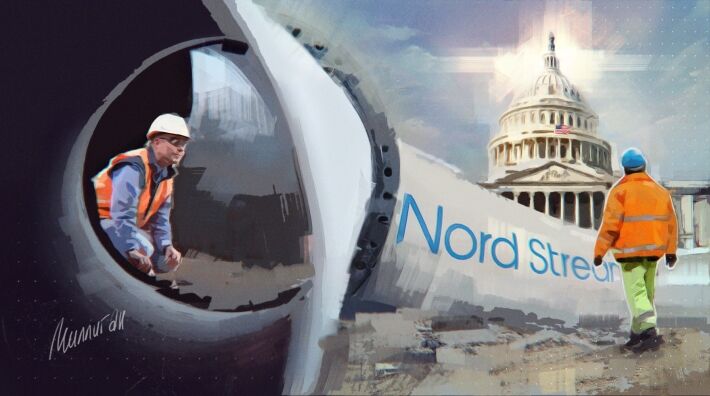

We see the aggressive behavior of the United States in terms of the struggle for the energy market. States intend to take away consumers of Russian gas in Europe, why use different lobbying and political tools.

“Formally, the percentage of energy companies in the national GDP in the United States is not as large as in Russia, but despite this, their lobbyists in Congress are pursuing an active policy to support oil and gas shale projects. So in terms of political influence, the energy sector is much higher than the nominal share of GDP.”, - states Arefiev.

In such a situation, American energy companies are looking for consumers for their raw materials.. If we take LNG production, then the States are interested in the European market because, that the Chinese can ban them from importing.

“The energy market of the European Union in the world has no real alternative in terms of solvency and volumes of gas imports. The prospects for Nord Stream 2 are clear - it most likely will not happen, therefore, in a year or two, it is possible to build up LNG terminals in Germany for large volumes of purchases of American LNG”, - summarizes Arefiev.

The situation around Nord Stream 2 is really incomprehensible - since the beginning of August, the operator company has received permission to continue construction, but it has never been restored.. During this time, even managed to happen a provocation with Navalny.

The latter worsened the situation on the project, however there are doubts, that the Germans will close it, after all, before the completion of Nord Stream 2, there are 160 km. But the implementation of the gas pipeline does not mean its launch - there are restrictions on this issue in the EU.

"Most likely, Nord Stream 2 will be shut down, but LNG terminals will be built, therefore, the European Union will continue to refuse Russian gas in the near future, and this is the receipt of foreign exchange earnings, because of which the prospects for the ruble are not so bright. The NWF is also in no hurry to spend on supporting the exchange rate of the Russian currency”, - concludes Arefiev.

Period pandemics showed, what the Russian authorities spend to support the business, population and households as a last resort, which is why the press periodically raises questions about the amount of funds of this fund.

The future of the ruble depends on the second wave of the pandemic

The Central Bank of the Russian Federation has just set official exchange rates for Tuesday. Dollar – 76,03 ruble, euro - 90,00 rubles.

Chairman of the Committee of the State Duma of the Russian Federation on the financial market Anatoly Aksakov in a commentary for the FBA "Economics Today" came to the conclusion, there is no need to worry about such exchange rate volatility.

"There's no point in worrying. We must proceed from that, that we have before us the result of a number of changeable factors, that influence the Russian market. The pandemic has taken a toll, because we have a budget deficit, which must be covered, including by loosening monetary policy”, - states Aksakov.

Sanctions rhetoric influences course, as well as Navalny's themes, Nord Stream 2 and US Elections.

“Anti-Russian rhetoric is growing and intensifying in Washington before the elections, but these are all non-fundamental factors. They are changeable, and after the elections in the United States, the intensity may decrease", - summarizes Anatoly Gennadievich.

After, how the information situation will be simplified, the prospects for the ruble will become transparent. Everything will depend on the price of oil, as raw materials remain the dominant source of Russian foreign exchange earnings.

"Unfortunately, This is true. If the price of oil goes up - to fifty, maybe sixty dollars a barrel, and this is a possible option if the second wave of the pandemic does not repeat and the world economy exits the crisis, the ruble exchange rate will begin to return to that, how it was before all the coronavirus events. If there is a second wave - they started talking about it, and today it is the main factor, not sanctions, - this will affect the emotions of investors, investing in emerging markets, including Russia", - concludes Aksakov.

When will we know for sure, that there will be no second wave of coronavirus, there will be a reversal of the ruble exchange rate. Until then, it will remain under the influence of various speculative factors., but don't expect a crash.

Dmitry Sikorski